[ad_1]

Good morning. This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

American stock exchanges are pursuing listings from companies in south-east Asia and India to counteract a slowdown in business from China.

Asian companies based outside China have been largely absent from the US stock market. But they are getting a closer look as Sino-US tensions cause new Chinese listings to dry up and threaten revenue for the New York Stock Exchange and Nasdaq stock market.

“The pipeline [for IPOs] has grown from a handful of companies, if you asked me a year ago, into a few dozen today” — Bob McCooey, Nasdaq’s Asia-Pacific chair

The outlook for US initial public offerings from Chinese companies has soured in the past few months amid mutual recriminations over the sharing of sensitive data and a crackdown on large private companies by Beijing.

American regulators have demanded greater disclosure from New York-listed Chinese companies after new rules from Beijing wiped billions of dollars from Chinese education companies and compelled ride-hailing group Didi to delist from US exchanges.

Thanks for reading FirstFT Europe/Africa. Here’s the rest of today’s news — Jennifer

Five more stories in the news

1. Vladimir Putin warns Nato of military response The Russian president has warned of “appropriate military-technical measures” to counter the threat of Nato’s expansion towards his country’s borders, in a ratcheting up of tensions with the western alliance. Meanwhile, the US said it would start diplomatic talks in an attempt to ease fears of conflict over Ukraine.

2. Water groups drained sewage network of investment England’s water and sewage companies have slashed investment in critical infrastructure by up to a fifth in the 30 years since they were privatised, according to new research that will stoke criticism over pollution and service failures.

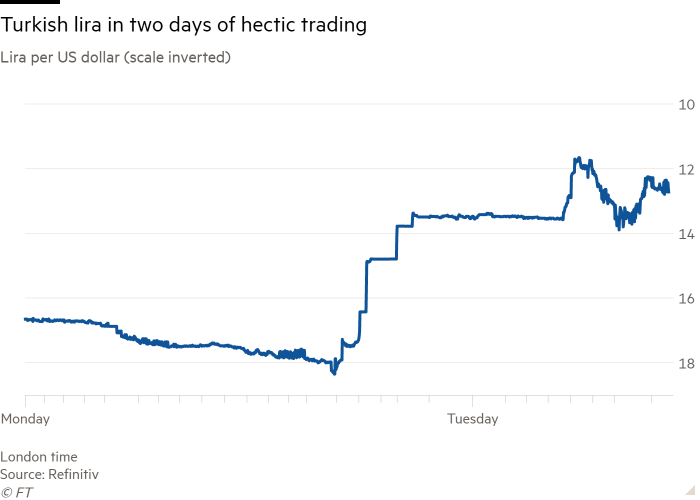

3. Turkish lira surges with savings scheme Turkey’s lira jumped sharply after President Recep Tayyip Erdogan unveiled a savings scheme that analysts described as a backdoor interest rate rise that could erode the public finances. The currency rose more than 40 per cent to trade at TL12.84 against the dollar yesterday.

-

Opinion: Will Turkey’s latest move stabilise the currency? That will depend on whether households and companies view the “circuit breaker” as a bridge to more comprehensive measures, or as an ultimately unstable destination, writes Mohamed El-Erian.

4. NatWest pleads guilty over spoofing Treasury markets The British bank has agreed to pay US authorities about $35m after pleading guilty to one count of wire fraud and one count of securities fraud related to schemes in the Treasury bond and futures markets.

5. Arsenal censured for ‘irresponsible’ fan token ads The UK advertising watchdog has issued a rebuke against the football club’s promotion of “fan tokens” in the regulator’s latest attempt to rein in marketing of cryptocurrencies and related products.

Coronavirus digest

Have you received a Covid-19 booster shot? Tell us in our poll below.

The day ahead

Covid measures in Europe Pedro Sánchez, the Spanish prime minister, has called a meeting of regional government heads to assess the potential introduction of more restrictive measures. Belgium will also consider new measures the same day. The UK government is expecting analysis on the severity of Omicron from Imperial College London researchers.

US growth figures for Q3 Goldman Sachs downgraded its US GDP growth forecasts this week, as doubts grow about whether President Joe Biden’s $1.75tn Build Back Better plan will be fully implemented. Existing-home sales are expected to have increased in November for the third consecutive month despite price rises and low inventories.

-

More economic data: France is due to release PPI figures and the UK is set to publish its ONS quarterly consumer trends report, plus quarterly business investment, sector accounts and economic accounts. (FT, WSJ)

What else we’re reading

Will the US help the Taliban? Millions of Afghans face starvation this winter after the withdrawal of foreign aid when the Islamist Taliban took power. Now there is diplomatic pressure on the US, Europe and other countries to unfreeze Afghanistan’s overseas central bank reserves and try to prevent what some fear will be a catastrophic humanitarian crisis.

$10bn telescope’s Christmas Day launch The James Webb Space Telescope, the most ambitious and costly telescope ever built, is set to be fired into space on December 25, with the aim of seeing deeper into the universe — and further back in time — than ever before. Astronomers are expecting a treasure trove of observations from our solar system, our galaxy and beyond.

How France lost Mali Like the Americans and their allies in their two decades in Afghanistan, the French have failed to eradicate the jihadi threat in Mali and the Sahel region. With the mood in the west African country becoming one of bitterness and anxiety, local leaders have turned to Russia, a shift that has consequences for security and France’s influence.

Who might replace Boris Johnson? The UK prime minister’s collapsing political fortunes makes him the target of abuse among ordinary voters. Johnson has bounced back before and is a proven election winner but if he fails, here’s who could come next.

Nick Bloom: ‘Hybrid is here to stay’ It is almost two years since Covid-19 triggered a mass experiment in homeworking. Yet there is no consensus among economists on how the shift might affect developed economies, in particular, when it comes to productivity. Bloom, a Stanford professor, argues that the revolution could usher in an era of globalisation in services.

Menswear

As Jedi knights and bullfighters will attest, when it comes to men’s outerwear, nothing matches the cape as a garment for pure theatre. In Charlie Porter’s parallel universe, he never leaves his home without one.

Thank you for reading and remember you can add FirstFT to myFT. Send your recommendations and feedback to firstft@ft.com

[ad_2]

Source link