[ad_1]

Welcome to FT Asset Management, our weekly newsletter on the movers and shakers behind a multitrillion-dollar global industry. This article is an on-site version of the newsletter. Sign up here to get it sent straight to your inbox every Monday. And please let me know your feedback: harriet.agnew@ft.com

When John Pierpont Morgan was asked what markets would do, the American financier is said to have replied “they will fluctuate”. In a similar spirit of avoiding bold predictions for 2022, which will probably be completely wrong anyway, I would instead point you to the FT’s biggest market moments of 2021 and the big market questions for 2022.

And here, with the help of my colleague, markets news editor and chart supremo Adam Samson, we sum up the year in asset management in six charts.

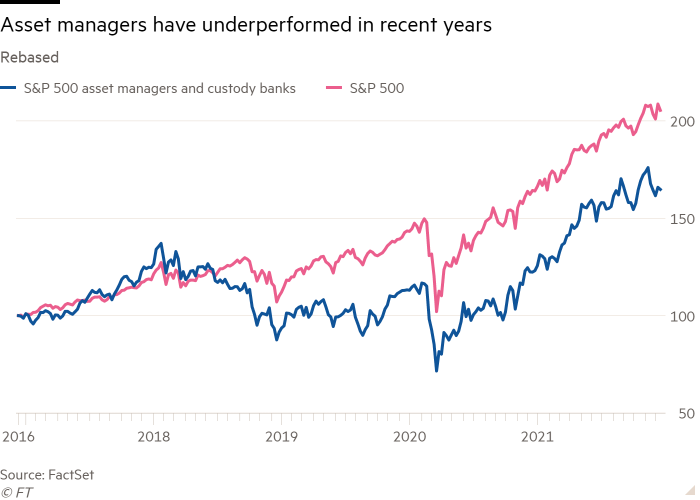

US-listed asset managers outperformed the wider market this year, but have lagged behind on a longer time horizon, reflecting the wider pressure on their business models. Consultant Oliver Wyman estimates that between 2015 and 2020 the average revenue margins of traditional asset managers decreased by 5 per cent a year. This decline could accelerate as conditions that drove markets to hit record highs are poised to reverse: notably bond yields rose this year, fiscal stimulus is being retracted and central banks are reining in asset purchases.

Julia Hobart, a partner at Oliver Wyman, says:

“This will create a reckoning for asset managers who have developed bloat in their businesses, become overly reliant on embedded beta driving inflows despite mediocre alpha, or who have been highly dependent on cheap leverage to prop up dealmaking volumes and fund returns.”

Meanwhile, in alternatives land, the biggest listed US private capital companies have soared in value, as investors seek to benefit from the hefty fees they rake in from the boom in unlisted assets. Their average revenue margins have increased by 2 per cent a year, according to Wyman. Last week, buyout group TPG became the latest to join the party, and filed to go public, following the UK’s Bridgepoint earlier this year.

Schroders said last week it is in advanced talks to buy a majority stake in renewables investment firm Greencoat Capital, the latest iteration of a busy year for dealmaking. Prominent transactions include T Rowe Price’s $4.2bn acquisition of credit manager Oak Hill Advisors; Goldman Sachs Asset Management buying NN Investment Partners for about €1.6bn, and Abrdn striking a £1.5bn deal to buy Interactive Investor, the UK’s second-largest funds supermarket.

Vincent Bounie, senior managing director at Fenchurch Advisory, says:

“Dealmaking is accelerating as asset managers look to tap into fast-growing areas with high barriers to entry, such as private assets, or expand their distribution into new markets. The continued trends of rising costs and downward pressure on fees is eating into profit margins and hastening the need for consolidation.”

It was a small but symbolic move: last week Franklin Templeton, a $1.55tn asset manager and one of the giants of the mutual fund world, said it is converting two mutual funds with about $250m into exchange traded funds. It illustrates a broader trend: ETFs are stealing market share from the mutual fund industry. Mutual funds are set to record a $44bn net inflow this year, compared with $850bn inflows for ETFs, according to the Investment Company Institute.

Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, says:

“The mutual fund structure has embedded costs and tax inefficiencies. In a world where you have zero-commission stock trading and can get exposure to a diversified basket of stocks through direct indices, it’s hard to say that the mutual fund is an efficient vehicle any more.”

Private markets are emerging as the next frontier for environmental, social and governance investing. The rise in demand for sustainable investments is driving a “structural reboot” of private market investing in Europe, according to PwC, driven by regulation and clients searching for yield and a hedge against inflation. Growth is primarily coming from a wave of new private market funds focused on ESG and impact investing, rather than older products being rejigged to invest sustainably. Groups including Tikehau Capital, M&G and Mirova have all launched funds in this space, illustrating how asset managers are stepping in to help finance the transition to a lower-carbon and greener economy.

Pierre Abadie, group climate director at Tikehau, says:

“Decarbonising the system requires more investment than is currently taking place. Clearly it’s a topic for institutional investors — it can’t be fulfilled by public money and philanthropy alone.”

Several hedge funds in the almost $4tn industry, notably Melvin Capital, were hit at the start of the year when retail investors overwhelmed the short sellers who had bet against GameStop. Then, in the spring and summer, many global macro managers betting on the reflation trade were caught out as longer-term bond yields fell, even though inflation was rising. October proved tough again, as short-term bonds tumbled, notably inflicting losses on Rokos Capital. And since late November many have struggled as the emergence of the Omicron coronavirus variant roiled markets. After posting in November the largest single-month decline since March 2020, funds are up 8.7 per cent in the first 11 months of the year. Overall, the average hedge fund looks set to fall short of the 11.8 per cent average return in 2020.

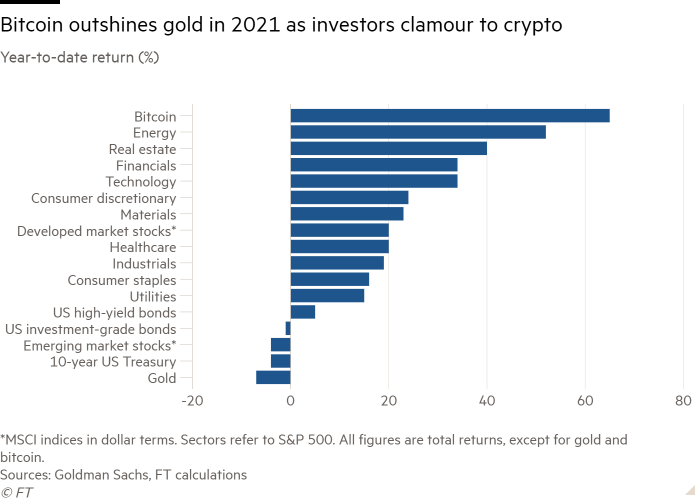

Gold is among the worst-performing major asset classes of 2021, despite accelerating inflation, as the precious metal’s lustre has faded next to what some see as its digital equivalent, bitcoin. The precious metal, often hailed as an inflation hedge, has dropped 5 per cent this year, despite investors looking for protection as consumer prices soar across the globe. Bitcoin, in contrast, has posted a big, if volatile, rally in 2021, with a 65 per cent appreciation year to date.

10 of our best longer reads in 2021

The ten trillion dollar man: how Larry Fink became king of Wall St

Tiger Cubs: How Julian Robertson built a hedge fund dynasty

Ark’s Cathie Wood: ‘Queen of the bull market’ faces her toughest test

‘They can do what they want’: Archegos and the $6tn world of the family office

ESG investing: funds weigh sovereign debt profits against human rights

Top investors split on direction of ‘tempestuous’ China’s markets

Baillie Gifford: can a new generation keep riding the tech boom?

Private equity and the raid on corporate Britain

Stay or sell? The $110tn investment industry gets tougher on climate

Robinhood IPO: why believers failed to deliver the ‘moonshot’

10 of our top news interviews in 2021

Evergrande fallout could be worse than Lehman for China, warns Jim Chanos

Tesla investor warns of ‘deep sickness’ in UK capital markets

Investors lulled into ‘dreamland’ by central banks, warns Bill Gross

Baillie Gifford’s Anderson: Don’t ‘give up on China’

Schroders chief urges reform of UK rules to thwart private equity raids

Crypto platforms need regulation to survive, says SEC boss

How Ken Griffin rebuilt Citadel’s ramparts

M&A alone not enough to save fund managers, says Amundi chair

Crypto has ‘no inherent worth’ but is good to trade, says Man Group chief

Spac boom is creating ‘castles in the sky’, Jim Chanos warns

And finally

France is tightening its border restrictions and blocking entry to UK tourists. So for now we can but dream of Paris: Anselm Kiefer at the Grand Palais; Madame Rêve, a new hotel in Paris’s legendary former 24-hour post office; and the exquisite potato “cappuccino” with bolognese ragù at Caffè Stern in the passage des Panoramas — the oldest of the covered passages of Paris.

Well that’s all, folks. Thanks for reading, and wishing you a happy and Omicron-free Christmas. We’ll be back in the new year. See you on the other side. Harriet

Thanks for reading. If you have friends or colleagues who might enjoy this newsletter, please forward it to them. They can sign up here

We would love to hear your feedback and comments about this newsletter. Email me at harriet.agnew@ft.com

[ad_2]

Source link