[ad_1]

Are there Native American home loans?

There are multiple home loan programs designed specifically for Native Americans, including three government–backed programs which we’ll explain below.

But, in many cases, Native Americans can use mainstream mortgage programs available to anyone. These can offer different benefits, including low or no down payment.

The right loan program for you will depend on your financial situation and where you want to buy. So explore all your options before settling on any one home loan program.

Check your home loan options. Start here (Dec 15th, 2021)

In this article (Skip to…)

Background on Native American home loans

Historically, Native Americans have had to clear more hurdles to get a mortgage loan than many other buyers.

The good news is, home loan options for Native American buyers are expanding.

As a result, the homeownership rate among Native American, Alaska Native, and Native Hawaiian (AIAN) populations in the United States has been growing: It rose to 50.8% in 2019, up from 38% in 2000. The rate for the whole U.S. population was 65.4% in the second quarter of 2021, according to the Census Bureau.

Why was it more difficult for Native Americans to get home loans?

The reason it used to be difficult to get a mortgage on trust lands comes down to a legal oddity: The land itself was always owned by the U.S. government trust, not by each home’s owner.

And that can be concerning for mortgage lenders. They want – when absolutely necessary – to be able to foreclose on the property and sell it to offset some of their losses. Selling a home when you don’t own the land is hard.

But it’s not impossible. All those who own condos are in the same boat. Their land and building are owned by a company and they lease their homeownership rights.

Still, trust lands were different from condos in some important legal respects. And many mortgage lenders took the easy path of simply not engaging with applicants wanting to buy on trust lands.

Recent improvements to Native American home loans

Recently, tribes have worked to overcome these issues by taking several legal steps to reassure lenders that homes on their trust lands make good security for loans.

This has improved the availability of many home loans, including conforming loans backed by Fannie Mae and Freddie Mac and federally–backed FHA, VA, and USDA loans. So it’s now much easier to get a mortgage on many trust lands.

Of course, if you wish to buy on non-tribal land, you should have no problems getting any mortgage you want, providing you qualify. About 40% of Native American households live outside tribal areas, according to the Federal Reserve Bank of Minneapolis, which has been a champion for expanding homeownership opportunities for AIAN communities.

Check your home loan options. Start here (Dec 15th, 2021)

Section 184: The Native American Home Loan

Many Native Americans or Alaska Natives who wish to buy a home are likely to choose a Section 184 mortgage, which is backed by the U.S. Department of Housing and Urban Development (HUD). Native Hawaiians can get loans through the Section 184A Program.

There are some very specific rules around who can use the Section 184 Native American Home Loan. But for those who qualify, there are unique benefits, too.

One important thing to note is that Section 184 loans are only available through select mortgage lenders approved by HUD. So if you want to use the Native American Home Loan Program, you should start with HUD’s list and contact a participating company in your area.

Benefits of the Section 184 Native American Home Loan

Here are some of the things you need to know about Section 184 mortgages:

- Low down payment: 2.25% on loans over $50,000 and only 1.25% on loans under $50,000

- No minimum credit score, but you must be creditworthy

- There’s a one–time 1.5% guarantee fee due at closing. But you can just add that to the loan amount

- If your down payment is less than 22% of the home’s value, you have to pay a mortgage insurance premium of 0.25% of your loan balance. That’s the annual amount, which will be split into 12 monthly installments and included with your mortgage payment

- Your mortgage rate is based on market interest rates, not your credit score

- No adjustable–rate mortgages are allowed

- The ” loan term” (length) of your mortgage can’t exceed 30 years

- You can only borrow for a single–family housing building comprising 1–4 units. No commercial buildings are allowed

In many of these respects, the Section 184 home loan is similar to other government–backed mortgage programs like FHA and VA loans. The low down payment and flexible credit score requirements can be especially helpful for first–time home buyers.

However, unlike the popular FHA loan program, you must be part of a recognized Native American tribe and buy a home in an eligible area to qualify for Section 184.

How can you use a Section 184 home loan?

HUD says: “You can use the Section 184 Loan to:

- Purchase an Existing Home

- Construct a New Home (Site–Built or Manufactured Homes on permanent foundations)

- Rehabilitate a Home, including weatherization

- Purchase and Rehabilitate a Home

- Refinance a Home (Rate and Term, Streamline, Cash Out)”

Those should cover the needs of most home buyers and existing homeowners.

Who is eligible for a Section 184 Native American Home Loan?

Your first eligibility hurdle is that you must be a Native American or Alaska Native who is a currently enrolled member of a federally recognized tribe. But there are other restrictions, too.

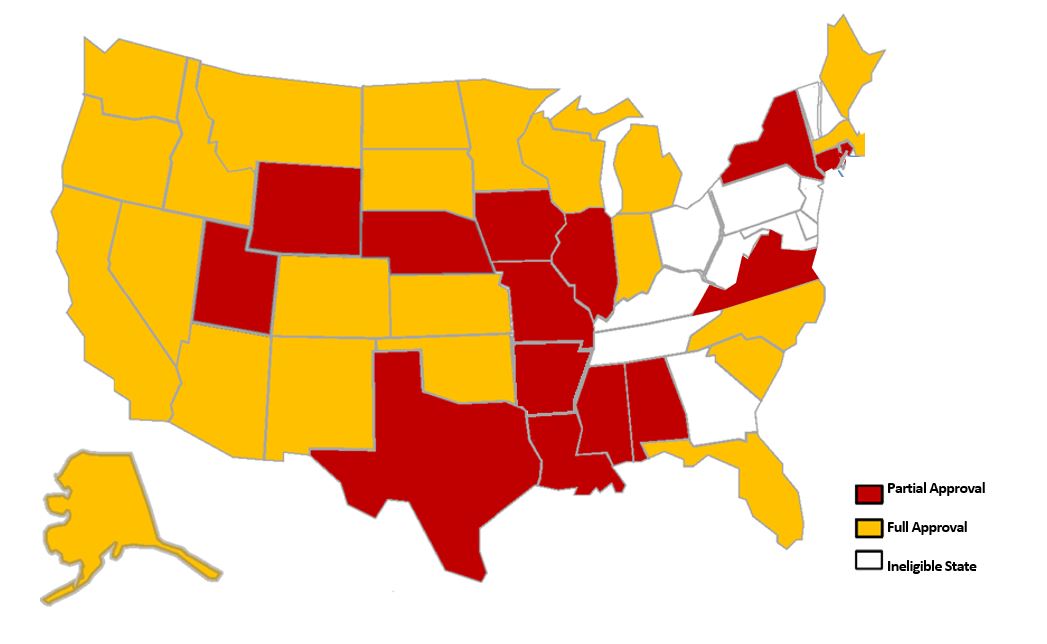

To start with, the home you wish to buy must be in an eligible area, as shown on this map from HUD’s website. Note that yellow areas are fully eligible and red ones partly so, while white ones are ineligible.

You can also consult a list of eligible counties by state.

You may be able to get a Section 184 mortgage even if you’re not buying a home on tribal land. Some tribes have designated entire states as eligible areas. So check with yours about restrictions.

You’ll also have to show your lender that you’re ready, able and willing to make your monthly mortgage payments on time.

Unusually, a Section 184 mortgage has no minimum credit score requirement. But you still must be deemed creditworthy. And the lender will want to see that you can comfortably afford those payments.

Section 184 loan limits

Section 184 Native American Home Loans follow loan limits which cap the amount you can borrow on a home purchase.

In most places, that cap is $331,760 for a single–family home, rising to $636,979 for a 4–unit building (you must occupy one of those units). But, in areas where home prices are unusually high, you may be able to borrow more, providing your income makes a larger loan affordable.

You can look up the county loan limits for the place you want to buy on this list.

Other mortgages for Native Americans

Native American home buyers are by no means required to use the Section 184 loan program. Depending on where you want to buy, it might actually be easier to use a mainstream loan program available to all borrowers.

Alternative mortgage options include:

Conforming loans

Fannie Mae and Freddie Mac both express their eagerness to expand their support for AIAN homeownership. If you want a mortgage that conforms to their rules (a “conventional conforming” loan), you’ll need a 3% down payment and a minimum credit score of 620.

VA loans – Native American Direct Loans

If you or your spouse is a service member or veteran of the U.S. armed forces, you may be eligible for a VA loan backed by the Department of Veterans Affairs. It has a special program for Native Americans (Native American Direct Loans) that “may help you get a loan to buy, build, or improve a home on federal trust land.”

Unlike other VA loans, the mortgages in this program are direct loans rather than private–sector ones. That means you’d get your loan directly from the VA rather than through a private lender.

Check the link above for eligibility criteria. But, if you qualify, you won’t need a down payment, you should get a low mortgage rate, and you won’t pay ongoing mortgage insurance premiums.

USDA loans

These are backed by the US Department of Agriculture (USDA). It says, “USDA Rural Development places a high value on its relationship with Tribes, American Indians, and Alaska Natives.”

And you may well be eligible for one of its mortgages under its Single Family Housing Guaranteed Loan Program. So check out USDA loans.

You’ll need to have a moderate or low income for the area where you want to buy. But, if you qualify, you won’t need a down payment. And your mortgage insurance premiums may be lower than with some other types of mortgages.

Check your home loan options. Start here (Dec 15th, 2021)

What lenders offer Native American Home Loans?

If you’re interested in the Section 184 Native American Home Loan program, your lender options will be somewhat limited. HUD has a list of approved lenders for the program. And you’ll have to choose one of those. Just get in touch with one to get the ball rolling.

When you use a ‘standard’ loan program, however, you can apply with any mortgage lender you want. And it’s in your best interest to shop around for the best loan terms and lowest interest rate.

Would you prefer to keep your money within your community? Well, there are many banks and credit unions owned by Native American, Alaska Native, and Native Hawaiian individuals and communities, as well as community development financial institutions primarily serving them.

Not all these financial institutions will offer mortgages. But some may. And local lenders may be more familiar with Native American home loan programs than big, nationwide companies. So it’s worth a look.

Use this map on the Federal Reserve Bank of Minneapolis’s website to identify those institutions that serve the area where you wish to buy a home.

Are there home buying grants for Native Americans?

Many first–time home buyers could use an extra hand with their down payment and closing costs. Luckily, there are thousands of programs nationwide offering financial assistance to those who need it.

For starters, there are down payment assistance programs in all 50 states. These provide grants or loans that can be used toward your upfront home buying costs. Some loans have to be repaid, but many are forgiven after you’ve lived in the home for a few years.

Most DPA programs are open to everyone who’s eligible. But there are some that are devoted to those in AIAN communities.

For example, the Federal Home Loan Bank of Des Moines’ Native American Homeownership Initiative (NAHI) offers up to $13,000 in assistance. And the FHLB/Woodlands National Bank – Native American Homeowners Initiative Grant offers grants (that don’t have to be repaid) of up to $10,000.

But those are just a couple out of many. You can use Google to find more options in your area. Or, ask your loan officer about down payment assistance. They should be able to help you find and apply for local programs.

Native American home loans FAQ

The section 184 mortgage program is run by the government department HUD. It exclusively helps Native Americans or Alaska Natives to become homeowners. Section 184 loans have low down payments, are easy to qualify for, and can be used on many tribal lands.

In most places, the most you can borrow with a Section 184 mortgage is $331,760 for a single–family home, rising to $636,979 for a 4–unit building (you must occupy one of those units). But that lower figure can be as high as $765,600 in places with sky–high home prices. Check the caps that apply in the county in which you wish to buy.

That depends on the wider mortgage market, which varies daily. HUD doesn’t quote rates. But it promises they’ll be low and based on market rates, not on the applicant’s credit scores

The Native American Direct Loan program is a type of VA loan. It may be easier to qualify for than ordinary VA loans. And it offers the same advantages, including exceptionally low mortgage rates, zero down payment, and no ongoing mortgage insurance.

There are thousands of down payment assistance programs across the nation. And some specialize in providing grants or loans to AIAN communities. They might also help with closing costs. Use a search engine or contact your state housing authority to find ones covering the area where you want to buy.

Check your home buying options

There are plenty of home loan options in today’s market. Native American home loans, including the Section 184 loan, can be a big help for eligible buyers. But mainstream loan programs are often just as good.

It’s worth exploring all your mortgage options before you buy. So get in touch with a lender and discuss your eligibility. Your mortgage advisor will be able to guide you toward the right loan type for your situation.

The information contained on The Mortgage Reports website is for informational purposes only and is not an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

[ad_2]

Source link