[ad_1]

This article is an on-site version of our Trade Secrets newsletter. Sign up here to get the newsletter sent straight to your inbox every Monday to Thursday

Hello from London where the arrival of Omicron has meant that tequila shots have been replaced with Covid-19 vaccine booster shots in the build-up to Christmas. The new variant of coronavirus offers an intriguing stress test on the degree to which economies will chug along or revert to behaviour conducive to bumpy supply chains, such as tough border restrictions and supercharged growth in online shopping.

Our main piece today is focused on whether ocean shipping disruptions have peaked. While many are confident that the turmoil has reached its nadir, it’s less clear to us that the logistics sector will enter 2022 on the up.

We want to hear from you. Send any thoughts to trade.secrets@ft.com or email me at harry.dempsey@ft.com

Shipping may be cheaper, but delays remain

There’s an air of optimism about supply chains right now. A dip in freight rates has led to suggestions from several macroeconomists penning their 2022 outlooks that the mess we have witnessed over the past year and a half is beginning to clear up.

Jan Hatzius, chief economist at Goldman Sachs, wrote in a note last week that “transport costs and shipping disruptions are starting to normalise”. Bel Air Investment Advisors, a wealth manager, said that “supply side issues such as shipping prices have already begun to normalise”.

Indeed, container spot market freight rates from east Asia to the US west coast have dropped significantly. After peaking at close to $9,000 per 40ft equivalent unit in November, the cost to ship cargo from the world’s manufacturing hub to the biggest consumer market has slumped more than 20 per cent to below $7,000, according to Xeneta, a data provider, and Compass Financial Technologies.

Further evidence of green shoots might appear to have come in the form of claims of a reduction in the number of waiting vessels and containers at the Los Angeles and Long Beach port complex.

The situation at LA/Long Beach has become harder to assess since mid-November, however, because of new rules that require vessels to remain many miles offshore until given approval to approach. While that has made it seem as if congestion has eased, ships were merely waiting to berth further away.

Even so, calls to the ports, which are the busiest in the US, have declined in recent months, from 261 ships in September, to 246 in October and 216 last month, according to Sea/, a data platform owned by broker Clarksons.

However, many within the industry are hesitant to say disruption has reached an apex. They are not as confident as the macroeconomists that ocean freight operations are on the road to normalising.

“We haven’t seen any discernible improvement in the supply chain. The risk of further disruption has heightened with the new variant,” said Simon Heaney, an analyst at Drewry.

He said the recent drop in freight rates was because of the seasonal drop in shipments that would no longer make it in time for Christmas, together with the decision by the likes of carriers CMA CGM and Hapag-Lloyd to freeze rates for those shipping at the last-minute.

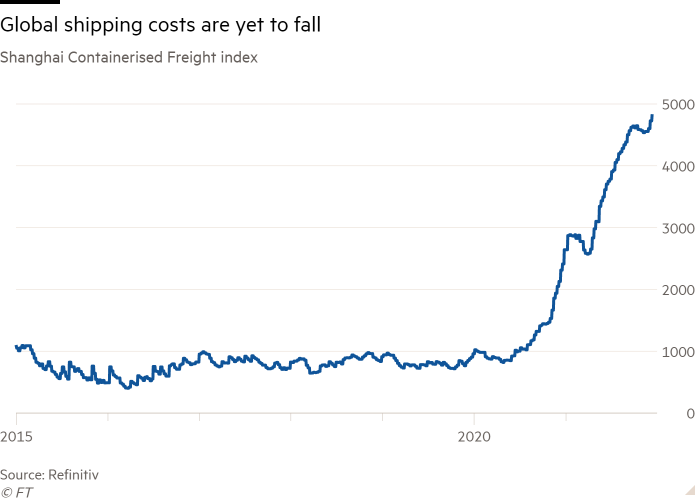

The decline in rates has also reversed on a global level. The Shanghai Containerised Freight index hit a record high last week at almost five times higher than the level at the start of 2020.

That is backed up by Flexport’s Ocean Timeliness Indicator, which measures the time from when cargo leaves an exporter until it is collected from the destination port. Both the China-to-Europe and China-to-US west coast routes remain at or close to records highs above 100 days.

Lars Jensen, chief executive of Vespucci Maritime, a consultancy, said that the recent reduction in vessel calls and easing of container congestion at Los Angeles/Long Beach had come at the expense of making the less visible queue of ships wait longer to dock. The number of container ships backed up waiting to berth was at a record 103 on Monday.

“At the heart of it, the problem is still you don’t have enough inland capacity to move the containers,” he said.

As Trade Secrets noted earlier this week, everyone from procurement managers to central bankers are craving more visibility on freight flows and bottlenecks through long, complex supply chains. Analysts, too, have been lamenting the lack of data tracking throughout the logistics network.

“Whether something is improving inland is pretty opaque. There is no easy-to-read index on warehouse capacity or availability. Nothing for chassis numbers. To get a broad picture regionally and globally, that is lacking,” Heaney said.

Of the many opacities in the supply chain, Peter Sand, of Xeneta, says that one of the most acute concerns is accurate data on Chinese government policy towards coronavirus outbreaks.

A spate of recent cases in Ningbo, a large port that was paralysed for a fortnight in August because of the pandemic, has sparked concerns of another shutdown that would set back any return to normality for ocean shipping. “The lack of transparency . . . is only adding to the mystery,” added Sand.

Some say having threads of information without a complete tapestry exacerbates the problems, leading to measures that ease strains in some areas only at the expense of worsening others. Jensen says the lack of a coherent picture not only prevents a solution to supply chain bottlenecks, but may even make matters worse. The reason: remedies for one issue may trigger snags elsewhere.

For example, Hamburg changed the rules concerning how early trucks with containers for export could arrive at the port. The idea was to reduce box congestion on the docks, quay and yard. A sensible move from a port perspective, Jensen said, but it led to a hold-up for many trucks already en route to the port, thus removing lorry capacity from Germany’s supply chain.

No doubt, a rush of capital-hungry supply chain visibility start-ups will claim they have the tools to provide the kind of useful data we all crave.

But if there is one thing that supply chains have proven during the pandemic, it’s that they are far from being technologically advanced enough for anyone to work out just how low shipping can sink. We cannot even call the nadir, let alone mitigate it.

Additional reporting by George Steer in London

Trade links

Air freight rates have soared to fresh highs as exporters rush to get their products on the shelves and into warehouses ahead of Christmas, providing yet more evidence that supply chain snags remain with us.

Ahead of a weekend referendum, public opinion in Taiwan favours reviving a ban (Nikkei, $) on US pork imports, a move that would have implications for Taipei’s relations with Washington.

Jude Webber has an interesting read on how Dublin’s port boom has revealed a shift in Ireland’s trade after Brexit. Francesca Regalado and Claire Jones

[ad_2]

Source link