[ad_1]

Home prices rose at a record pace in 2021, putting pressure on buyers to get bigger and bigger mortgage loans.

Luckily, loan limits are keeping pace with home price inflation.

Starting January 1, 2022, the new conforming loan limits will reach up to $647,200 in most of the U.S. and $970,800 in high-cost areas.

And you don’t have to wait until 2022 to take advantage. Many lenders are already offering higher loan limits today.

Verify your conventional loan eligibility. Start here (Dec 8th, 2021)

In this article (Skip to…)

Conventional loan limits for 2022

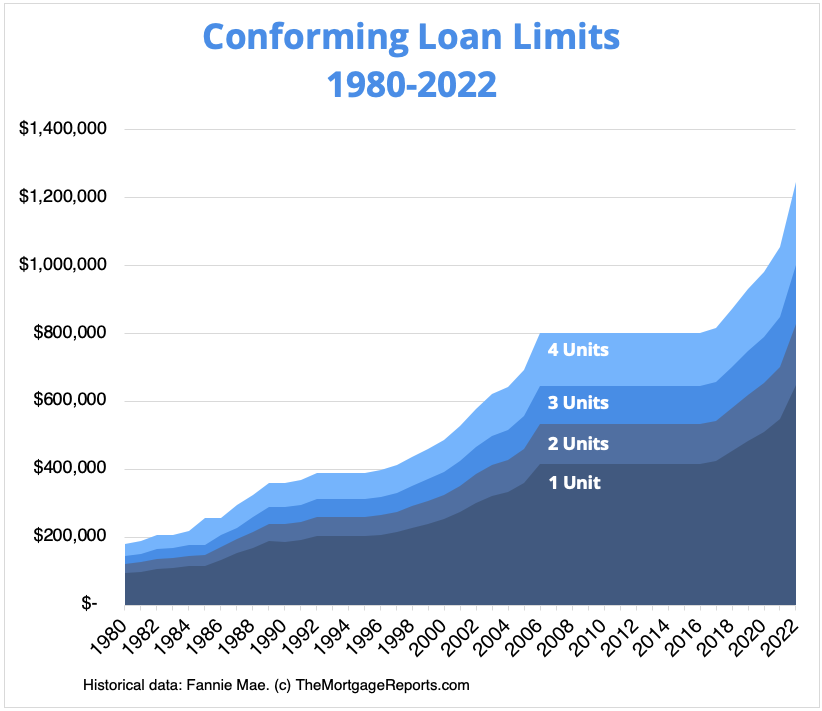

Lending limits for conventional conforming loans got a huge boost this year.

The Federal Housing Finance Agency (FHFA) determined home prices are up by more than 18% on average across the nation.

It raised conforming loan limits by the same percentage — a dollar increase of almost $100,000 for the standard one-unit home. Multi-unit properties got a similar increase.

| Low-Cost Area | Medium-Cost Area | High-Cost Area | |

| 1 Unit | $647,200 | $647,201-$970,799 | $970,800 |

| 2 Units | $828,700 | $828,701-$1,243,049 | $1,243,050 |

| 3 Units | $1,001,650 | $1,001,651-$1,502,474 | $1,502,475 |

| 4 Units | $1,244,850 | $1,244,851-$1,867,274 | $1,867,275 |

Baseline conforming loan limits

Standard loan limits for 2022, which apply in most of the United States, are as follows:

- 1-unit homes: $647,200

- 2-unit homes: $828,700

- 3-unit homes: $1,001,650

- 4-unit homes: $1,244,850

Keep in mind that these are only the ‘baseline’ limits. In areas with high-cost real estate, buyers get significantly higher conventional mortgage limits.

Maximum conforming loan limits

High-balance conforming loan limits vary by county. They can fall within the following ranges:

- 1-unit homes: $647,201-$970,799

- 2-unit homes: $828,701-$1,243,049

- 3-unit homes: $1,001,651-$1,502,474

- 4-unit homes: $1,244,851-$1,867,274

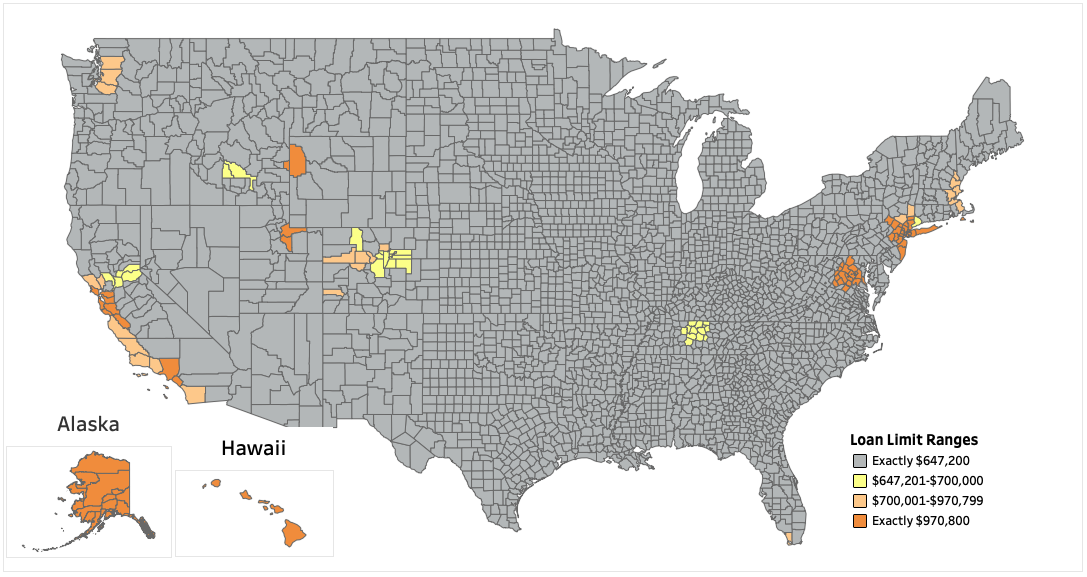

Areas such as Alameda County, California; Arlington, Virginia; and Jackson, Wyoming enjoy the maximum conforming loan limits, while cities like Seattle, Washington and Baltimore, Maryland fall between the “floor” and the “ceiling.”In Alaska, Hawaii, Guam, and the U.S. Virgin Islands — which follow their own loan limit rules — the baseline loan limit for 2022 is $970,799 for a one-unit property.

Verify your home buying eligibility. Start here (Dec 8th, 2021)

Conforming loan limits by county for 2022

The following map shows conforming loan limits by county. You can see an interactive version of the loan limits map on FHFA’s website.

What is a mortgage loan limit?

A loan limit is the maximum amount you can borrow under certain mortgage programs.

There is not just one loan limit, but many.

Conventional mortgages adhere to one set of loan limits, and FHA another. VA loans essentially did away with limits in 2020.

In the world of conforming loans, Fannie Mae and Freddie Mac limit “borrowable” amounts to keep their nationwide programs available to those who need them.

For instance, Fannie Mae doesn’t want a $10 million loan going through its system. That’s a lot of risk wrapped up in one transaction, and the agency would rather issue many smaller loans to many home buyers.

Fortunately, loan limits are on the rise in 2022 to reflect rising home prices across the country.

What is a conforming loan?

A conventional conforming loan is any mortgage that:

- Is not backed by the federal government (meaning it’s not an FHA, VA, or USDA loan)

- Has a loan amount within local conforming loan limits

- Meets lending guidelines set by Fannie Mae and Freddie Mac

Mortgages within conforming loan limits are eligible to be backed by Fannie Mae and Freddie Mac, as long as the borrower meets basic criteria for credit score, income, down payment, and debt levels.

Conforming loans typically require:

- A credit score of at least 620

- A debt-to-income ratio below 43%

- A down payment of at least 3%

- Two-year history of stable employment and income

Exact conforming loan requirements

can vary by lender, but they all have to meet the minimum guidelines set by

Fannie and Freddie.

These

standards give lenders and investors more

confidence in these loans.

As a result, conforming loans are available with ultra-low mortgage rates and just 3% down payment.

Check today’s conforming mortgage rates. Start here (Dec 8th, 2021)

What if my loan is over the conventional limit?

Remember that the conforming loan limit applies to the loan amount, not the home price.

For instance, say a buyer is purchasing a 1-unit home in Boulder, Colorado where the limit is $747,500. The home price is $1 million, and the buyer is putting $400,000 down.

This buyer is eligible for a conforming loan. The final loan amount is $600,000 — well within limits for the area.

Still, many applicants will need financing above their local loan limit. For them, a number of solutions exist.

Jumbo loans

The simplest method is to use a jumbo loan. Jumbo mortgages describe any home loan above local conforming limits.

Using the example above, let’s say the Boulder, CO home buyer puts down $200,000 on a $1 million home. In this case, their loan amount would be $800,000 — above the local conforming loan limit of $747,500. This buyer would need to finance their home purchase with a jumbo loan.

You might think jumbo mortgages would have higher interest rates, but that’s not always the case.

Jumbo loan rates are often near or even below conventional mortgage rates.

The catch? It’s harder to qualify for jumbo financing. You’ll likely need a credit score above 700 and a down payment of at least 10-20%.

If you put down less than 20% on a jumbo home purchase, you’ll also have to pay for private mortgage insurance (PMI). This would increase your monthly payments and overall loan cost.

The next method helps you avoid PMI when buying above conforming loan limits.

Verify your jumbo loan eligibility. Start here (Dec 8th, 2021)

Piggyback financing for high-priced homes

Perhaps the most cost-effective method is to choose a piggyback loan. The piggyback or “80/10/10” loan is a type of financing in which a first and second mortgage are opened at the same time.

Typically, this structure is used to avoid private mortgage insurance.

A buyer can get an 80 percent first mortgage, 10 percent second mortgage (typically a home equity line of credit), and put 10 percent down.

However, these loans are also available for those putting 20 percent down or more. Here’s how it would work.

- Home price: $850,000

- Down payment: $170,000 (20%)

- Financing needed: $680,000

- Local conforming limit: $647,200

The buyer could structure their loan as follows.

- Down payment: $170,000

- 1st mortgage: $647,200

- 2nd mortgage: $32,800

The home is purchased with a conforming loan and a smaller second mortgage. The first mortgage may come with better terms than a jumbo loan, and the second mortgage offers a great rate, too.

What’s the jumbo loan limit for 2022?

Technically there’s no jumbo loan limit for 2022.

Since jumbo mortgages are above the conforming loan limit,

they’re considered “non-conforming” and are not eligible for lenders to assign

to Fannie Mae or Freddie Mac upon closing.

That means the lenders offering jumbo loans are free to set

their own criteria, including loan limits.

For example, one lender might set its jumbo loan limit at $2

million, while another might set no limit at all and be willing to finance

homes worth tens of millions.

But the amount you can borrow via a jumbo or

non-conforming loan is limited by your finances.

You need enough income to make the monthly mortgage payments on your new home. And your debt-to-income ratio (including your future mortgage payment) can’t exceed the lender’s maximum.

You can use a mortgage calculator to estimate the maximum home price you can likely afford. Or contact a mortgage lender to get a more accurate number.

What if I’m getting an FHA loan?

FHA loans come with their own loan limits. Standard FHA limits for 2022 are listed below.

- 1-unit homes: $420,680

- 2-unit homes: $538,650

- 3-unit homes: $651,050

- 4-unit homes: $809,150

You might notice that FHA’s limits are considerably lower than the conforming limits. That’s by design.

The FHA program, backed by the Federal Housing Administration, is meant for home buyers with moderate incomes and credit scores.

But the FHA also suits home buyers in expensive counties. Single-family FHA loan limits reach $970,800 in high-cost areas within the continental U.S. and a surprising $1,456,200 for a 1-unit home in Alaska, Hawaii, Guam, or the Virgin Islands.

What are today’s conentional mortgage rates?

Mortgage rates for conventional conforming loans are stellar, which is why so many buyers consider a conforming loan before using jumbo financing.

Get

a rate quote for your standard or extended-limit conforming loan. Compare to

jumbo rates and piggyback mortgage rates to make sure you’re getting the best

value.

[ad_2]

Source link