[ad_1]

Will the housing market improve in 2022?

The 2021 housing market was a tough one for home shoppers.

Low rates and increased flexibility from working remotely put many first-time homebuyers on the map. But limited inventory, skyrocketing prices, and fierce bidding wars made housing harder to come by.

But things may soon level out to a more ‘normalized’ market, according to real estate experts. We could see competition start to taper off and price growth begin to moderate.

In short, 2022 should be a better market for buyers.

Verify your home buying eligibility. Start here (Nov 20th, 2021)

In this article (Skip to…)

>Related: How to buy a house with $0 down: First-time home buyer

Housing market forecast for 2022: Overview

We spoke with seven real estate and mortgage experts to get their housing market predictions for 2022.

Most agree the market will remain hot, as it will take a long time to regain inventory. But they also agree competition and prices should moderate somewhat compared to the past year.

Real estate market demand and demographics

Ask Rick Sharga, executive vice president for RealtyTrac, and he’ll tell you that the housing market should continue its strong performance through 2022.

“Demand will continue to be driven by low mortgage rates and demographics. Consider that the largest cohort of millennials is approaching prime age for first-time homeownership,” he says.

“The pandemic has also contributed to the recent boom in home buying, in part due to the ability many employees now have to work from home and to health concerns, which encourages city dwellers — mostly renters — to look for more spacious residences in areas with lower population density.”

Potential for improvement

Paul Buege, president and COO of Inlanta Mortgage, also thinks the market will remain strong. But he foresees prices and demand cooling off at least a little in 2022 compared to the last year or two.

“Positive indicators are hinting to a more favorable housing market in 2022. The heated pace of sales is beginning to show signs of moderation, and this is helping to increase the number of homes for purchase,” says Buege.

“With more homes on the market, prices should begin to moderate. This suggests that the balance between sellers and buyers will shift toward a more normalized market next year.”

Look out for rising mortgage rates

Chuck Biskobing, a real estate attorney at Cook & James, agrees that home price gains should start to level off next year. But he also cautions that higher interest rates could result in less buying power for prospective purchasers.

“If inflation does not abate, the Fed and market may push rates higher more quickly than expected, which can take a toll on affordability,” Biskobing explains.

If your home buying plans hinge on today’s near-record low rates, that may be reason enough to continue your search now rather than waiting until 2022.

Verify your home buying budget at today’s rates. Start here (Nov 20th, 2021)

Home price predictions for 2022

Housing prices have been on a record-setting rise in 2021.

According to CoreLogic, home sales prices increased by more than 18% between September 2020 and September 2021. This came on the heels of “the largest annual gain in home prices” in 45 years (August 2021).

Unfortunately, home values aren’t likely to stop rising or start falling any time soon.

But the good news is, last year’s double-digit percentage gains might slow down, which could take some of the pressure off prospective buyers.

Home price gains could slow to around 5%

“I expect home prices to continue to rise, primarily due to limited supply. However, price increases will moderate next year to accommodate household affordability,” says Albert Lord, founder and CEO of Lexerd Capital Management.

He notes that the national median listing price in August was $380,000 — 16% higher than in 2020. “For 2022, I predict an increase in home prices by 5%,” says Lord.

Interestingly, one expert believes home prices are only just catching up from the previous decade.

“They’re just now only getting to where they should be on a 20-year arc,” believes John Hunt, founder and principal of MarketNsight.

“The boom and bust of the Great Recession held prices down, especially for resale, for a decade. Consider that the average price appreciation over the last 20 years is 4.5%. We will be heading back to that normal in 2022 and beyond.”

A recent study from the National Association of Realtors makes a similar argument but from the supply side. It connects current low inventory to the years of under-building during and after the Great Recession.

High demand means price trends won’t reverse

Nik Shah, CEO of Home.LLC, anticipates home price appreciation cooling slightly next year.

“Nevertheless, we expect prices to continue increasing in 2022, fueled by millennial demand, low interest rates, and low housing inventory levels,” Shah continues.

Sharga points out that the work-from-home movement may continue to enable people to move from more expensive markets to smaller, less expensive areas, which would dramatically inflate single-family home prices in some of the smaller markets.

“On the other hand, we might see some price corrections in a few of the higher-price markets like the Bay Area in California,” he adds.

Home inventory predictions for 2022

With the real estate market drifting toward a more normalized pace, many industry experts envision the number of existing homes for sale increasing next year, especially as current homeowners look to move.

“Supply will also continue to be supported by the growing inventory of available new homes for purchase coming online next year,” says explains Buege. He expects some investors to start selling off rental properties, too, to take advantage of today’s high prices.

Ralph DiBugnara, founder of Home Qualified, agrees that supply should improve somewhat in 2022. But he warns that the lack of inventory of homes for sale will continue to be a problem.

Housing inventory could improve a little in 2022, but will likely remain a problem for years to come.

“According to Fannie Mae, we will still see an almost 50 percent shortage of homes available to meet a normal demand of buyers,” he says. “I believe it will take two to three years for the inventory shortage to normalize again.”

And don’t forget that supply chains remain disrupted from COVID, and worker shortages continue to present challenges to home builders.

“I believe we will be in a state of housing shortage for another decade,” says Hunt. “We still have the problem of city and county governments not permitting higher-density product, which allows for affordable and workforce housing.

“Also,” he adds, “boomers who should be selling their homes and adding to inventory are not moving — mainly because they have nowhere to go due to lack of inventory. It’s a vicious cycle that I expect will last for a very long time.”

Mortgage rate predictions for 2022

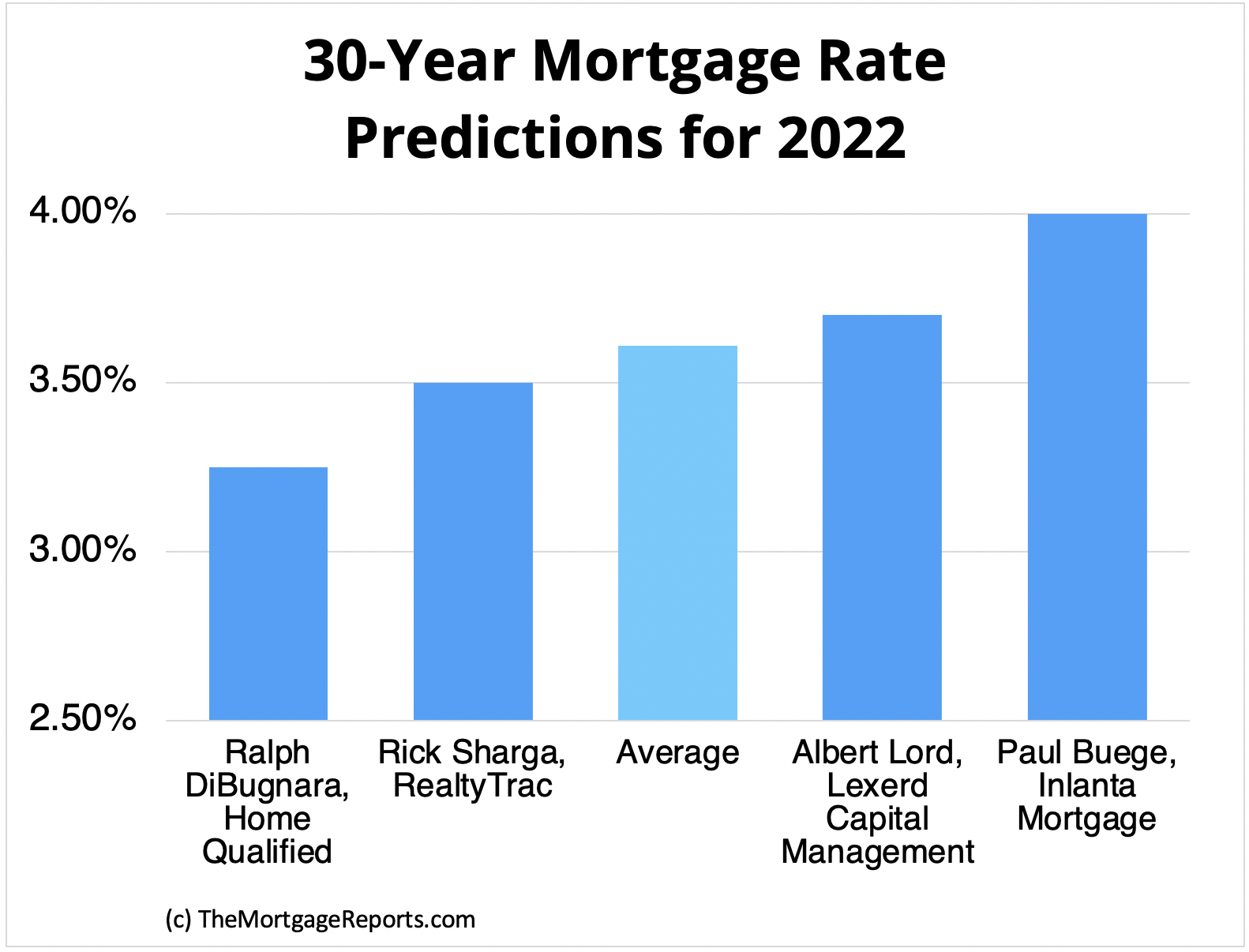

Probably the most pressing question posed to the pros is a predictable one: Where will rates for the benchmark 30-year fixed-rate mortgage land next year?

DiBugnara believes we can expect relatively low rates to continue, at least for a while.

“The national average interest rate will likely stay somewhere around 3.25% for 2022. There is not enough stability in the market to sustain a large increase in interest rates,” he says.

Rick Sharga of RealtyTrac, by contrast, is forecasting an average rate of 3.5% by mid-year 2022 and an end-of-year rate of 3.75%.

“Mortgage interest rates are likely to go up for several reasons, including continued economic growth and higher yields on U.S. 10-year treasuries, which often directly influence interest rates on 30-year fixed-rate loans,” Sharga says.

“Another significant factor is the Federal Reserve’s recent announcement that it would begin to taper its purchases of $40 billion a month in mortgage-related securities, which alone should give mortgage rates a bump.”

Lord subscribes to that theory.

“Based on my economic analysis, I predict a modest rate increase to 3.7% in 2022. Rates cannot increase drastically, given the current fiscal environment,” adds Lord.

Others wouldn’t be surprised if rates creep even higher than these estimates.

“Look for 30-year fixed rates to move and then hold steady in a rate range of 3.75% to 4.25% by late 2022. Even with that jump, keep in mind that mortgage interest rates will remain at historically favorable levels,” says Buege.

Find your lowest mortgage rate. Start here (Nov 20th, 2021)

Will the housing market crash in 2022?

There’s one thing the experts all agree on: Don’t expect a real estate market crash, similar to what occurred in 2008, anytime next year.

“The economy has made a remarkable recovery from the pandemic-driven recession and will likely have regained virtually 100 percent of the jobs lost during the downturn by the end of 2022,” says Sharga.

Plus, many of the forces behind the foreclosure-fueled 2008 crash simply don’t exist right now.

“Home price appreciation is being driven by supply and demand — not speculation or bad lending practices like years ago — and household formation continues to increase as Gen Y and Gen Z come of age,” he explains.

DiBugnara reminds us that relaxed credit and income guidelines to qualify for a mortgage — as well as an abundance of home inventory — significantly contributed to the last housing market crash 13 years ago.

“Today, we have much stricter lending rules and guidelines for purchasing a home along with a shortage of homes for sale,” says DiBugnara. “Due to lingering high demand and continued lack of homes to purchase, it would be very hard for a market crash to materialize.”

Biskobing concurs.

“I can imagine a scenario where the Fed is forced to raise interest rates faster than expected, but even if they do I don’t expect a market crash,” he says.

Should you buy a home now or wait?

In-depth predictions are all well and good, but you may have a simpler question: Should I buy a home now or wait things out?

“That depends on a buyer’s unique circumstances,” Lord says.

Who should wait until 2022 to buy?

It might be best to wait if your finances aren’t in the best position to afford a mortgage payment or secure a low interest rate.

“You may want to consider renting until you can satisfy the homebuying rule of thumb of 30/30/3,” continues Lord. This rule dictates that:

- Your monthly mortgage payments should not exceed more than 30 percent of your household’s gross income

- You should obtain a 30-year mortgage

- You should aim for around a 3% fixed interest rate

For some people, though, now is a great time to buy despite current challenges in the market.

Who should buy a home now?

If you are seeking to raise a family and/or stay put without moving over the next five to 10 years, now is a great time to claim a home and lock in a preferred mortgage rate, insists Sharga.

“For most families, homeownership is a good long-term strategy that results in forced savings and the creation of intergenerational wealth. It also provides a stable environment for a family,” he explains.

“But homeownership comes with a lot of financial responsibility. And there’s also some possible short-term risk, as home values can fluctuate, sometimes going down. I generally tell prospective buyers to move as fast as they can, but only when they’re sure they’re ready from a financial perspective.”

Should you refinance now or wait until 2022?

Most homeowners know the low-rate environment of the pandemic economy made mortgage refinancing more attractive.

But home price growth during this seller’s market also makes now a good time to refinance. If your home is valued higher than it was a couple years ago, you could have more home equity even if you didn’t make a large down payment.

Keep in mind, a larger equity share can help lower your rate when you refinance. And that’s not the only benefit.

At least 20 percent in home equity means you could refinance out of the FHA’s mortgage insurance premiums and into a Freddie Mac or Fannie Mae conventional loan without PMI.

Your lender will need to order a new home appraisal to confirm your home’s new value. An estimation of value from Zillow or even from your loan servicer may not be accurate.

Verify your refinance eligibility. Start here (Nov 20th, 2021)

Focus on yourself rather than timing the market

Above all, avoid trying to perfectly time the market.

“People spend too much effort in trying to game the housing system,” Biskobing says. “But guessing at market moves, and especially interest rate moves, is a fool’s errand.”

He continues, “Buying a house should be a practical decision based on where one is in their life financially and on their life path. Low rates argue for buying now if you can afford it and have a stable job with healthy earnings.”

Your loan adviser can walk you through your loan options, down payment requirements, interest rates, and home buying budget.

Then you can make an informed decision about whether to talk to a real estate agent to buy now or wait.

[ad_2]

Source link