[ad_1]

The vice-chair of the US Federal Reserve on Friday opened the door to a faster withdrawal of its massive bond-buying programme, suggesting the central bank could take earlier-than-expected action to tame inflation.

Richard Clarida said the Federal Open Market Committee could consider discussing the pace of the planned “taper” at its upcoming policy meeting in December.

Earlier this month, the Fed began winding down its $120bn-a-month purchases of Treasuries and agency mortgage-backed securities, and said it intended to reduce them by $15bn each month. That puts it on track to remove the stimulus entirely by the middle of next year.

At the time, the Fed said that it was “prepared to adjust the pace” of the tapering process “if warranted by changes in the economic outlook”.

On Friday, Clarida reiterated his view that he sees “upside risk” to inflation and expects “very strong” growth in the fourth quarter of 2021.

“I’ll be looking closely at the data that we get between now and the December meeting, and it may well be appropriate at that meeting to have a discussion about increasing the pace at which we’re reducing our balance sheet,” he said at an event hosted by the San Francisco Fed.

A faster withdrawal of the asset purchase programme could pave the way for earlier interest rate increases given that Jay Powell, the Fed chair, has said the central bank would probably avoid adjusting its policy rate while it is still buying government bonds.

Earlier on Friday, Christopher Waller, a Fed governor, said he would prefer a faster taper, which would give the central bank more flexibility to raise rates “if necessary”.

“The rapid improvement in the labour market and the deteriorating inflation data have pushed me towards favouring a faster pace of tapering and a more rapid removal of accommodation in 2022,” he said at an event hosted by the Center for Financial Stability.

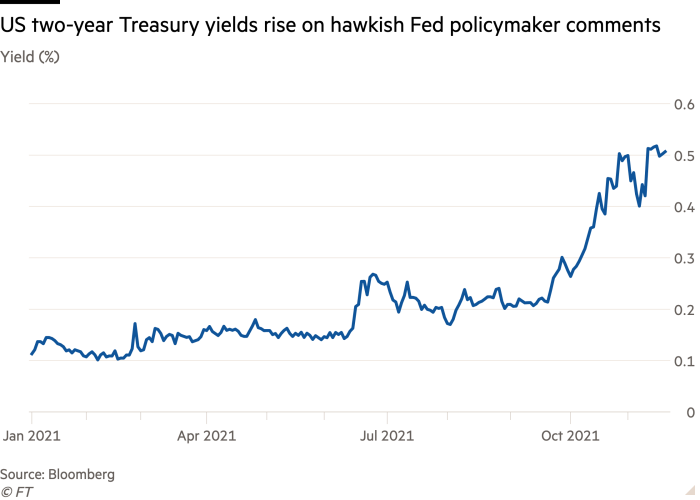

The price of shorter-dated government debt has tracked policymakers’ every word and Clarida’s comments sent reverberations through the $22tn Treasury bond market.

The yield on the two-year note, which is the most responsive to Fed policy shifts, jumped 0.07 percentage points from a low hit earlier in the trading session when Treasuries had been rallying. At 0.51 per cent, it remained just below a 20-month high hit earlier this week. Yields rise when a bond’s price declines.

Implied rates on federal funds futures also rose following the comments from Clarida, with traders pricing in a full quarter point interest rate increase by the Fed by July.

US equities weakened following the report, with the benchmark S&P 500 reversing an earlier advance that had taken the index to within a hair of a new record high. The benchmark closed down 0.1 per cent on the day.

Ashish Shah, the co-chief investment officer of fixed income at Goldman Sachs Asset Management, said he believed the central bank was attempting to give itself more flexibility to respond to economic data, including the highest inflation readings in 30 years.

“The Fed is going to become much more data dependent as time goes along and we would expect that policy uncertainty is going to rise as we head into the second half of next year coming out of the taper,” he said.

[ad_2]

Source link